🏥 Investing in Medical Technology

baby vc - Healthcare & Life Sciences Masterclass Series - Key takeaways from Session on 26.06.24 - (Estimated read time: 10 min)

Written by Mariam Makhmutova, Edited by Ghita Benjelloun Benkacem, Annika Bautista and Sarah Luna Mongin 🖤.

Last week, we delved into the world of Therapeutic venture investments, covering essential criteria, drug modalities, and regulatory considerations. We also took a closer look at VC strategic entries, equity stories, and exits, using the Apollo Health case study as an example.

This is part 3 of 4 in our specialised newsletter series on Healthcare and Life Sciences investments, where we recap our masterclass on Medical Technology. Rather than repeating well-known concepts, we aim to provide candid insights and fresh perspectives from top investment and startup leaders in the field. In this edition, we will explore:

Introduction of our speakers

Defining Med Tech

MedTech Ecosystem in Europe

Investment landscape

Building a MedTech company

Intellectual Property

Navigating Regulatory Compliance

Global Outlook and Return on Investment (ROI) in MedTech

Let’s start with the…

1. 🎤Introduction of our speakers

Dr. Johannes Fischer is a Partner at Wellington Partners Life Science, a VC firm headquartered in Germany that focuses on early- and growth-stage life science companies from Europe and beyond. Wellington Partners has raised more than €600 million for life sciences, invested in +60 companies, and made 27 life science exits, IPOs, and trade sales. Prior to joining Wellington Partners, Johannes was a Management Consultant at the Life Sciences practice of L.E.K. Consulting. Johannes holds an MSc in Biochemistry, a PhD in Biotechnology and a Medical Doctorate from Technical University Munich, Germany.

Dr. Jan Engels is an Investment Manager in the Life Sciences division at High-Tech Gründerfonds (HTGF), one of the leading and most active early-stage investors in Germany and Europe with over €2 billion under management. Since 2005, HTGF has financed more than 750 high-tech start-ups, of which 200 are in life sciences. Jan holds a PhD in chemistry and nanotechnology, has co-founded a medical device start-up in the field of ophthalmology and drug delivery and has substantial experience in technology patents and business development.

James Fok is a CFO at Lifelight, a game-changing, contactless technology, that allows a mobile device to estimate blood pressure and pulse, by simply looking into the device’s built-in camera for 40 seconds. James has extensive finance, operations, and execution experience in building finance functions from the ground up in small and startup businesses. James has broad knowledge across different professional fields having worked alongside CEOs and UNHWI as their principal advisor. James also holds an MBA from MIT and MEng from Imperial College.

2.💡Defining MedTech

MedTech, is a broad and evolving field that encompasses a wide array of tools and innovations designed to enhance healthcare delivery and improve patient outcomes. This domain ranges from diagnostic tools, imaging systems, and surgical instruments to wearable devices and AI-driven diagnostic platforms.

Verticals include:

🩺Remote monitoring & portable care - Devices or systems that enable the continuous monitoring of patients' health remotely, often using wearable technology or mobile devices, e.g. a wearable heart monitor.

🔬Diagnostics & life sciences - Tools and technologies used to detect, monitor, and understand diseases or biological conditions, often through tests or analysis, e.g. a genomic test.

💉Surgical devices & tools - Instruments and technologies used to assist or perform surgical procedures, enhancing precision or safety e.g. robotic-assisted surgery systems.

🏥Non-surgical medical treatments - Devices or treatments that provide therapeutic benefits without the need for surgery, often involving minimally invasive methods, e.g., laser therapy devices.

🩻Medical imaging - Technologies that create visual representations of the interior of the body for clinical analysis and medical intervention, e.g., MRI machines.

During the discussion, Jan and Johannes emphasised the significance of the hardware components within MedTech, particularly in contrast to pure software solutions, which might more accurately fall under the umbrella of Digital Health💻🔗. Indeed, the often mentioned overlap between Digital Health and MedTech was noted, particularly as the label "MedTech" has become somewhat broad and occasionally imprecise.

Adding to this point, James highlighted that some software solutions could indeed be classified as MedTech companies, depending on their service provisions and the regulatory requirements they meet. This perspective underlines the importance of context and regulatory frameworks when defining what constitutes a MedTech company.

3. 🌍MedTech Ecosystem in Europe

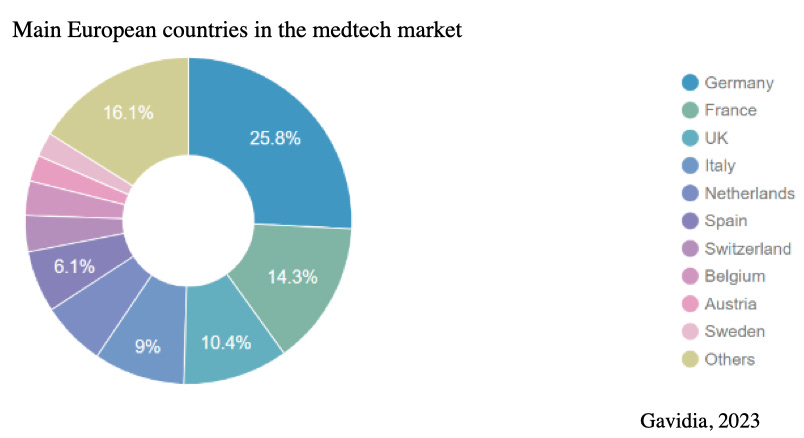

The MedTech market in Europe is robust, with an estimated value of approximately €160 billion in 2023 (MedTech Europe, 2023). The highest concentration of MedTech companies is found in Germany, followed by France, the UK, Italy, and Switzerland. Between 2024 and 2029, the market is projected to grow at a steady annual growth rate of 5.31%. In Europe, spending on medical technology ranges from 5% to 12% of the total healthcare expenditure.

Jan pointed out that Germany's strength in engineering plays a crucial role in its prominence within the MedTech space. Many engineering companies in Germany are actively involved in the MedTech sector, bringing valuable expertise and innovation to the field. Additionally, 📍Germany offers strong government support programs for incubating innovative startups, such as EIC grants, which are also accessible to UK companies.

When discussing the current landscape of MedTech in Europe, Johannes noted that we are now witnessing the development and market entry of second and third-generation products. These innovations build upon the clinical value propositions established by their first-generation predecessors, such as pacemakers, ablation systems, and endoscopy solutions. While the underlying principles of treatment remain consistent, these new products offer differentiated approaches that enhance patient care.

Jan further expanded on this by discussing the growth of non-invasive surgical innovations, particularly in the realm of medical imaging and operational theatres. He emphasised that novel AI solutions in surgical imaging are transforming the way surgeries are performed, offering unprecedented precision and improving patient outcomes.

4.💰Investment landscape

The current funding environment for MedTech startups presents significant challenges, particularly at both the early and growth stages. The investment landscape for MedTech has experienced significant fluctuations in recent years. In 2023, the total value of MedTech deals involving venture capital (VC) financing was $21 billion, a sharp decline of 31.1% from $30.5 billion in 2022. This drop was even more pronounced compared to the sector's peak in 2021, when VC financing deals reached $49.3 billion (Medical Device Network, 2023).

Johannes, however, pointed out that the overall statistics might obscure some key trends, particularly the fact that MedTech financing has become more concentrated among a smaller group of investors. Some investors have shifted away from MedTech over the years, as seen with funds like Forbion, which started as a mixed fund but is now known as a dedicated biotech investor. Indeed, the challenges posed by the COVID-19 pandemic🦠 and the subsequent impact on VC returns have led to a ⏰heightened focus on resource efficiency and clear value propositions due to decreasing investor confidence.

Overall, Johannes and Jan confirmed that there are relatively few funds that focus exclusively on MedTech, and some of those that do often shy away from high-risk ventures, such as those involving medical class III devices. This is due to the high cost and regulatory hurdles associated with bringing such technologies to market create a substantial barrier to entry🚧, making it challenging for startups to secure the necessary investment.

When asked about what investors are currently looking for in MedTech startups and how the investment landscape has changed over the past decade, Johannes stressed the importance of targeting large markets with a niche approach that is scalable. James added that📝intellectual property (IP) is critical in making a MedTech startup investable. Without robust IP, startups are vulnerable to reverse engineering and other risks. For early-stage investments, IP is particularly crucial, as it provides the foundation for future growth and protection against competition.

Johannes added that startups need to find specialised funds that align with their specific technology, and while there are a few such funds in Europe, more opportunities for specialised funds exist in the U.S. However, Johannes emphasised that there are two "valleys of death" in MedTech funding: the initial phase where startups struggle to get their technology off the ground and the critical phase where in vivo proof of concept is required. Without a strong network, securing funding during these stages can be exceptionally difficult.

James shared his personal experience, having just concluded a six-month fundraising journey. He encountered particular challenges when raising funds in the U.S. due to regulatory expectations. Investors were hesitant when they learned that his startup was pursuing CE certification instead of FDA approval, which led to reduced interest. Despite these hurdles, James successfully closed an undisclosed funding round, partially supported by a specialized fund. The remainder came from financial investors, where the company had to demonstrate the financial feasibility of its SaaS aspect and its potential to scale. James echoed Johannes’s concept of the two valleys of death, noting that while his company has overcome the first, they are still navigating the challenges of the second.

Johannes remarked that while the environment in which MedTech companies operate has changed, the need for strategic investors remains closely tied to the broader global macroeconomic landscape. Despite the current challenges, both Johannes and Jan maintain an optimistic outlook, emphasising that as early-stage VCs, optimism is essential. James concurred, noting that the pressure to demonstrate financial returns has altered startup behaviour, pushing companies to prioritise commercial viability and revenue generation more rapidly than before.

5. 🏗️Building a MedTech company

As the discussion shifted to the topic of building a successful MedTech company, the panelists debated whether disruptive technology or a disruptive business model should come first. Johannes and Jan agreed that the answer depends on the stage of the company. For growth-stage companies, the focus should be on 💵commercial potential and the ability to meet market expectations, including sales, manufacturing, and scalability. For early-stage companies, however, the technology itself and the strength of the IP are paramount.

Johannes and James expressed caution regarding 🪙overly complex business models. He noted that while ambition is important, the real measure of success is the ability to generate revenue. He emphasized that his investments are typically focused on straightforward business models, such as product sales, service contracts, and software subscriptions, rather than overly ambitious financial engineering. However, Jan added that while it is important for early-stage founders to have a business model in mind, at this stage, the priority should be ensuring that the technology works and that the IP is solid🗃️.

6. 🧠 Intellectual Property

Regulatory compliance and IP are critical aspects of MedTech, particularly when it comes to hardware development.

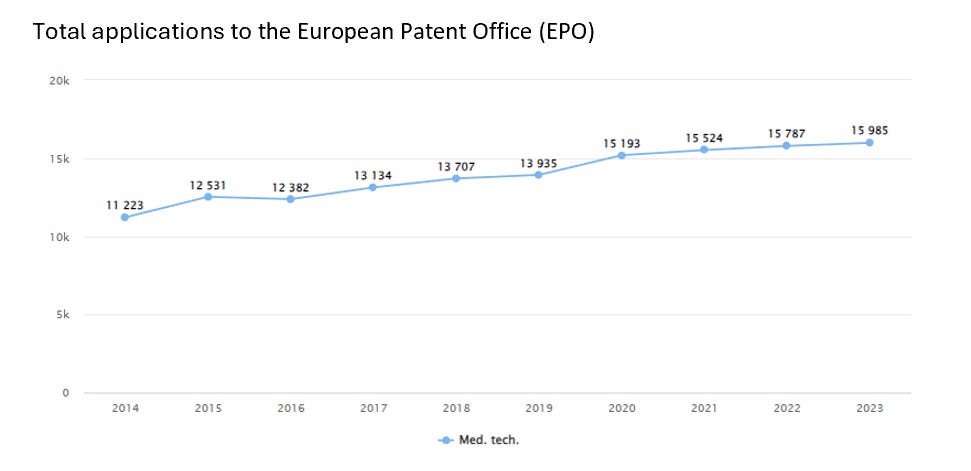

In 2022, over 15,700 patent applications were filed with the European Patent Office (EPO) in the field of medical technology, accounting for 8.1% of the total number of applications. This makes MedTech the second-highest sector in Europe in terms of patent filings🚀.

James, whose company is focused on software, highlighted the unique challenges of patenting in this space, where data plays a key role in success. His advice to other entrepreneurs is to develop a forward-looking IP strategy that anticipates future needs and potential challenges.

❗️Jan warned against skimping on legal expenses related to IP and patent filing. He shared that his startups have filed patents globally—not just in the U.S. and Europe, but also in Japan, Brazil, and South Africa—to ensure comprehensive protection and scalability. Johannes echoed this sentiment, urging startups to seek expert advice on IP early in their development to safeguard their innovations and position themselves for long-term success.

7. ⚖️Navigating Regulatory Compliance

Regulatory compliance is a critical aspect of the MedTech industry, particularly when it comes to hardware. Johannes emphasised that the regulatory landscape in MedTech is evolving rapidly, with new rules and requirements emerging regularly. One significant shift has been the transition from the Medical Devices Directive (MDD) to the Medical Device Regulation (MDR)📄.

This change has introduced stricter requirements for companies, particularly in terms of demonstrating how 🧰invasive their devices are and the potential risks they pose to patients🧑⚕️. The more invasive a device, the more rigorous the regulatory process, which necessitates the production of extensive data.

Johannes and Jan both expressed concerns about Europe's regulatory environment for MedTech, describing it as overly complex and burdensome, a point highlighted in the previous Digital Health session. Johannes noted that this complexity has driven many companies to shift their focus to the U.S. market, where regulatory processes are seen as more manageable.

He added that high costs and compliance difficulties have caused some companies to discontinue European operations, leading Wellington Partners to encourage a U.S.-first strategy➡️. Gaining approval in the U.S. often simplifies entry into Europe.

Jan echoed this view, attributing the trend to the complications introduced by the Medical Device Regulation (MDR). While the MDR was intended to streamline processes, it has added challenges, such as the need for new certifications for all devices. He highlighted the U.S. FDA's more collaborative approach, which allows companies to pre-submit applications for feedback, improving approval chances.

8. 🌐Global Outlook and Return on Investment (ROI) in MedTech

When it comes to return on investment (ROI) in the MedTech sector, Johannes and Jan shared insights into common and evolving exit strategies. Trade sales to larger industry players are the most common exit route, as noted by James Fok. However, for companies like Lifelines, which operate in the software space, the focus is on growth, with multiple exit options being considered. Lifelines is primarily concentrating on maximising revenue potential to diversify its exit options in the future.

Jan pointed out that when MedTech companies engage with major industry players, these players typically look for two key factors: 🤝market approval and market traction. Mergers and acquisitions (M&A) activities rarely occur before these stages are reached. Although it would be encouraging to see more initial public offerings (IPOs), particularly in regions like Germany, where IPO activity is currently weak, the reality is that most MedTech companies exit at around €100 million. Exits above this threshold are rare and particularly impressive.

9. 👉 Key takeaways:

💉 Integrated diagnostics, robotics, and wearables/biosensors are leading growth sectors driven by demand for precision medicine, minimally invasive procedures, and personalised healthcare solutions.

🧨 MedTech startups face two valleys of death: early-stage funding and technical feasibility, and later-stage challenges in clinical validation, regulatory approvals, and market acceptance.

🗂️ A robust IP portfolio is crucial for VC investment in MedTech, providing a competitive edge, protection against imitation, and pathways for revenue beyond product sales.

💡 The EU Medical Device Regulation (EU-MDR) complicates innovation with stringent requirements, prompting some European MedTech startups to focus on the U.S. go-to-market strategy.

💵 Simple reimbursement strategies are vital for investor confidence, given the slow pace of business model innovation in MedTech due to regulatory and technical complexities.

10. 🔬Last stop: TechBio

With this session, we gained valuable insights into the complexities and opportunities within the MedTech investment landscape. Stay tuned for Part 4 of our series, where we will explore emerging trends and future outlooks in TechBio!

Scaling and Investing in TechBio ventures 🔬

Written by Zeno Fox, Edited by Ghita Benjelloun Benkacem, Annika Bautista and Sarah Luna Mongin 🖤.

💡 Let’s keep the conversation going!