💊 Investing in Therapeutic ventures

baby vc - Healthcare & Life Sciences Masterclass Series - Key takeaways from Session on 13.06.24 - (Estimated read time: 10 min)

Written by Loubaba El Ayoubi, Edited by Dr. Anela Vukoja, Annika Bautista and Sarah Luna Mongin 🖤.

Last week, we explored what it means to invest in Digital Health ventures, diving into the key investment drivers, business models, and current trends. We also examined the regulatory impact associated with PPP (Public-Private Partnership), which plays a crucial role in this domain.

This is part 2 of 4 in our focused Newsletter on Healthcare and Life Sciences investments, where we recap our masterclass session on Therapeutics. Our goal is to go beyond simply restating widely accepted ideas and instead, delve into honest thoughts and fresh perspectives from expert investment and startup leaders in the field. In particular, we will cover:

Speaker and Fund Presentation

Defining Drug Modalities

Key Investment Criteria in Therapeutics

Drug Development Process and Regulatory Bodies

VC Strategic Entries, Equity Stories, and Exits: An Apollo Health Case Study

IP and Patent Strategy

Key Takeaways

1. Speaker and Fund Presentation

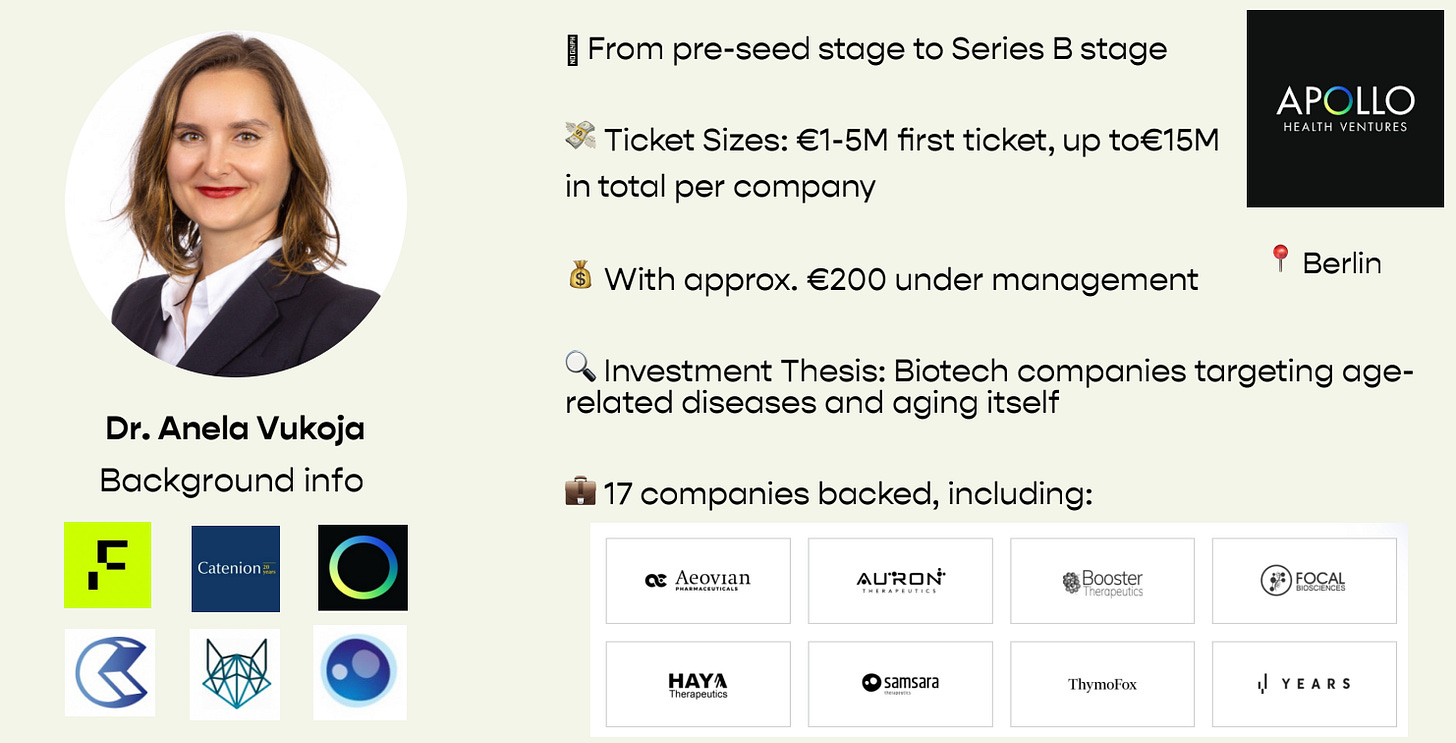

For this session, we were honored to welcome Dr. Anela Vukoja who brings her wealth of experience. Dr. Vukoja is currently the Chief Operating Officer at Apollo Health Ventures, where she is a part of the investment team. She serves as Director on the boards of Samsara Therapeutics, Cleara Biotech, and Refoxy Pharmaceuticals. Prior to her current role, she was a manager at Catenion, where she advised pharmaceutical and biotech companies on their R&D strategies. Dr. Vukoja holds a PhD in Neuroscience from the Free University of Berlin and holds a passion for age-related diseases and therapeutics.

Apollo Health Ventures is a transatlantic early-stage Venture Capital firm with approximately $200 million in assets under management. The firm focuses on co-founding and investing in transformative biotech companies that target age-related diseases and aging itself. Apollo Health Ventures invests from pre-seed to Series B, and takes an active role in its portfolio companies, typically as lead or co-lead investor.

2. Defining Drug Modalities

The discussion began by defining what we mean when we talk about therapeutics: drug modalities. A drug modality refers to the form of treatment used to interact with biological systems (target), to address diseases. These can include small molecules, which are simple compounds that can easily enter cells and influence biological processes, and cell therapies, which involve using live cells to repair or replace damaged tissues or cells. Other modalities include oligonucleotides, used to modify genetic material at the RNA or DNA level, peptides like insulin, antibodies, and many more. There are also numerous modalities still in development within the industry.

👉 Drug modalities vary in size and atomic structure, impacting their complexity, molecular mass, cell permeability, and ultimately their mode of action on the target.

Many factors are considered when choosing a drug modality:

💡 Level of expertise and know-how: For example, small molecules are well understood. We know how to optimize, scale, and project costs for them.

🏠 In-house or externalized development: Known antibodies, for instance, can be outsourced, whereas more advanced or novel antibodies may require in-house development due to unique engineering expertise.

💸 Risk and investment profiles: The cost of bringing a small molecule to market is vastly different from that of a cell therapy.

Sometimes, a fund's investment thesis can focus on the technology itself, where innovation comes from the modality which can be seen as a novel tool that can be applied to many diseases. Of course, a use case must be selected to demonstrate its effectiveness. On the other hand, investments can be centered around a specific disease, such as stroke, where the company has identified a particular target for that indication.

From Anela’s perspective, innovation often works in waves, and this is especially true for drug modalities. However, you can only catch a glimpse of each wave, so what really matters is identifying the problem you're solving and selecting the best tool, or modality, to address it. With that said, one area that may seem distant but holds great potential for the future is regenerative tissues—being able to rejuvenate tissues. While this has been demonstrated in academic settings, translating it to human applications remains a significant challenge.

3. Key Investment Criteria in Therapeutics

According to Anela, when approaching a new startup and conducting due diligence to decide whether to invest, we need to follow a methodical approach, which includes considering:

🧬Biology of the Disease: Assess the disease biology, where and how the proposed target and modality fit within the pathologic process and whether measurements are available to assess the drug’s effect.

🔬Technology Evaluation: Look at the novelty of the target, how well-established it is, and whether it’s a primary driver of the disease. The "target" refers to the specific molecule or biological pathway that the drug interacts with to produce a therapeutic effect. Ideally, the target should be directly involved in causing the disease, rather than a secondary factor.

🧪Preclinical Development Plan: Plan the experiments to de-risk development, ensuring there's enough relevant data to move forward.

⚙️Mode of Action (MoA): Determine if the drug’s interaction with the target is translatable across models (in vitro, animal models) and eventually to humans.

📏Translatability and Measurement: Evaluate if the effect of the drug in humans can be measured effectively and consistently.

👥Patient Segmentation: Assess whether the company can segment the population into subgroups with a higher chance of responding to the drug.

4. Drug Development Process and Regulatory Bodies

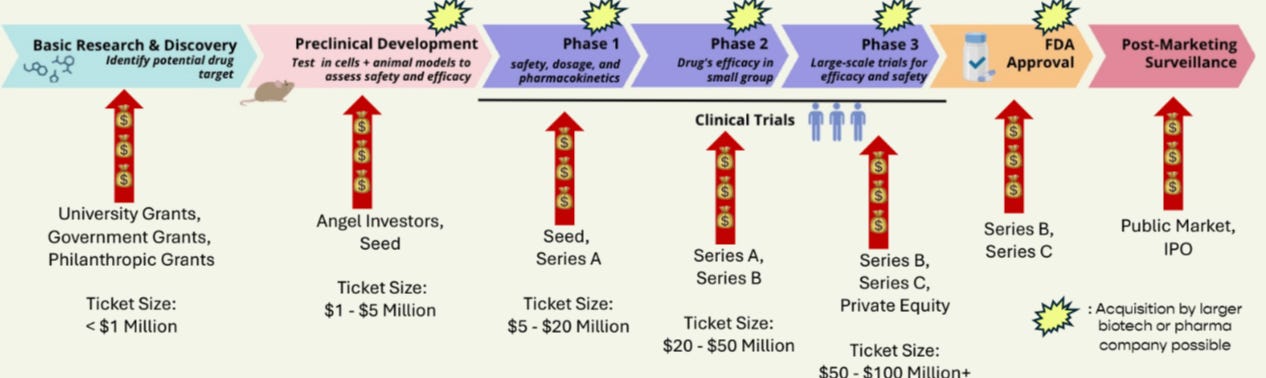

The drug development process is notoriously inefficient, with significant efforts being made to improve it. Typically, this process takes 10-15 years and costs billions of dollars, with an overall failure rate exceeding 96%.

1. The Preclinical Phase

The FDA and EMA, the regulatory agencies for therapeutic approval in the US and EU, respectively, set the standards that many other geographies follow. These agencies have strict requirements, with the goal to ensure the development of safe and efficacious drugs based on scientific evidence. The preclinical phase focuses heavily on ensuring safety, particularly potential toxicity, as well as efficacy against the target and in disease models. In the preclinical phase, the modality is evaluated in vitro (done in a laboratory dish or test tube) and in vivo (on a living organism). This is critical, as it must show safety to regulatory bodies before human trials can begin.

💡Drugs are typically tested for safety in two different types of animals: rodents and either dogs, or other larger mammals such as non-human primates or pigs. The choice of species depends on a variety of factors which are discussed between regulatory agencies and drug developers. For small molecules, rodents and dogs may suffice, but for cell therapy, non-human primates are often required. The reason for this is the need to understand the immune system’s reaction thoroughly. Moreover, the human body’s reaction to small molecules can be quite well modeled in rodents and dogs due to extensive prior experience with the modality; this is not the case with more advanced therapies and novel modalities.

2. Human Testing

Here, the process begins very conservatively with small doses, which are not expected to show efficacy but are used to ensure safety. This takes place in Phase 1. If this looks promising, meaning the potential benefits outweigh the potential risks (e.g., side effects are likely to be tolerable compared to the severity of the disease), the trial moves into Phase 2.

In Phase 2, the first signs of clinical efficacy are typically what the drug developers are looking for. A relatively small number of patients are used to demonstrate that the treatment produces results when compared to another drug on the market or the current standard of care. This is called a clinical proof of concept.

💡At this stage, and if the data is deemed attractive, it is possible to secure an in-licensing deal from a big pharma company or even a potential acquisition. As early-stage investors, this is typically the phase to look for a potential exit.

In Phase 3, larger trials are conducted to demonstrate both the safety and efficacy of the treatment, ensuring that the benefits are clinically significant. Once these trials are successful, the treatment can receive approval from regulatory bodies like the FDA and EMA.

5. VC Strategic Entries, Equity Stories, and Exit Valuations

Basic Research and Discovery are rarely funded by VCs, as they are typically supported by grants from universities, government, or philanthropic organisations. Preclinical Development is where early-stage investors often get involved. The size of the funding round and the investment ticket can vary greatly depending on the company’s progress and the complexity of the experiments required to test the molecule (e.g., small molecule vs. cell therapy). A seed round may fund the company through nomination of a "Development Candidate," which is the molecule or technology selected for safety and toxicology studies in animals. At this point, the chosen candidate cannot be changed, as it is the one intended for human trials. Ticket sizes for this stage typically range from $1 to $5 million, though rounds can reach $10 to $20 million.

Once a development candidate is secured, companies typically raise a Series A round, which can fund them through safety and toxicology assessment or all the way through clinical Proof of Concept. Individual investor ticket sizes here usually range from $5 to $10 million. After clinical Proof of Concept, several paths are possible: the company could go public, seek private equity funding, or be acquired.

👉🏻It's important to note that VCs typically invest from preclinical development to Phase 2, where most exits occur, although exits can sometimes happen even earlier in favorable situations.

As Anela explained, when speaking of exits, valuations in biotech are completely different compared to other sectors where metrics like EBITA or revenue typically drive valuations. In biotech, it boils down to understanding how significant the unmet need is and how much the market is willing to pay to solve that need. That’s why the first proof of concept in humans, demonstrating some level of efficacy is so critical. The more convincing the data, the greater the chance for a lucrative exit for investors.

Apollo Health Ventures Case Study - Samsara Therapeutics

Apollo Health Ventures founded Samsara Therapeutics from the ground up, providing the initial seed funding to prove the feasibility of their screening process. They also financed the larger screening process that identified potential "hits". Apollo then led a syndication for the Series A round to bring the company closer to Phase 1 clinical trials.

Samsara is a platform company, meaning it doesn’t focus on one asset for one disease, but has multiple assets targeting completely different diseases. These assets are connected by a common biological process, and while all their current assets happen to be neurological, they target different conditions. A company with three assets nearing clinical trials has different financial demands compared to one with a single asset.

👉🏻Early-stage investors are often drawn to platform companies because they spread the risk with multiple "shots on goal." However, platform companies also tend to require more capital than single-asset companies, as noted by Anela.

6. IP and Patent Strategy

Intellectual property (IP) plays a pivotal role in the pharmaceutical industry—it serves as a key asset that can be retained, sold, or licensed, and it's where much of the investment value lies. Without patents, competitors could easily replicate innovations, diluting any competitive edge. However, IP is a complex issue, with ethical concerns surrounding its impact on drug affordability.

Typically, patents are granted for 20 years, but the timing of filing is a critical strategic decision. Filing too early risks wasting valuable time during the research and development phase, leaving less time for market exclusivity. This is especially important for small molecules, which are easily replicated, but less so for advanced therapies. Companies aim to strike a balance between protecting their innovation and ensuring they have ample time to market their product before the patent expires.

For example, Novo Nordisk is very active in mergers and acquisitions to mitigate the impact of LOEs (Loss of Exclusivity), driven by the success of its current drugs. In addition to IP, pharma companies also acquire know-how and human capital—essential for handling cutting-edge technologies—making talent and infrastructure just as valuable as the patent itself.

7. Key Takeaways

💰𝐑𝐢𝐬𝐤 𝐚𝐧𝐝 𝐂𝐨𝐬𝐭 𝐏𝐫𝐨𝐟𝐢𝐥𝐞: Each therapeutic modality has a different risk and cost profile, which should be considered in a VC investment thesis. For example, taking small molecules to clinical trials is typically less costly than cell or gene therapies.

🎯 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬 𝐟𝐨𝐜𝐮𝐬 𝐨𝐧 𝐬𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐬𝐭𝐚𝐠𝐞𝐬 𝐨𝐟 𝐝𝐫𝐮𝐠 𝐝𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭. Early-stage investors aim for convincing clinical proof of concept by phase 2 for potential exits. For example, POC in neurological diseases is often achieved sooner in rare diseases like ALS than in Parkinson's or Alzheimer's.

📊 𝐊𝐞𝐲 𝐢𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭 𝐜𝐫𝐢𝐭𝐞𝐫𝐢𝐚 𝐢𝐧𝐜𝐥𝐮𝐝𝐞: Unmet medical need, Mode of Action of the treatment, novelty and validation of the target, availability of biomarkers, patient numbers needed to show an effect, translatability of MOA across models, ability to segment responsive patients are some of the key considerations. These criteria vary greatly from other investment types.

🔀 𝐄𝐚𝐫𝐥𝐲 𝐢𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬 typically 𝐩𝐫𝐞𝐟𝐞𝐫 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐜𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬. This is due to diversified risk and multiple opportunities. However, companies with multiple assets approaching the clinic have higher financial demands than single-asset companies.

📝𝐓𝐢𝐦𝐢𝐧𝐠 𝐟𝐨𝐫 𝐟𝐢𝐥𝐢𝐧𝐠 𝐩𝐚𝐭𝐞𝐧𝐭𝐬 𝐢𝐬 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜. Filing later is better to maximize market protection, but it carries the risk of being copied.

We hope you enjoyed this deep dive and look forward to seeing you next week for the third feature in our written series dedicated to investing in and scaling ventures in healthcare.

Next stop: Medical Technology, better known as Medtech 🩻!

🏥 Investing in Medical Technology

Written by Mariam Makhmutova, Edited by Ghita Benjelloun Benkacem, Annika Bautista and Sarah Luna Mongin 🖤.